Stay on top of your subscription payments and reduce churn with ThriveCart’s Dunning Notifications — an automated system designed to keep your customers informed and payments flowing smoothly. With upcoming payment alerts, customers receive friendly reminders before a charge occurs, while overdue payment reminders help recover missed payments quickly and efficiently. This seamless communication not only improves customer retention but also protects your revenue by ensuring no payment slips through the cracks.

ThriveCart’s built-in dunning functionality allows you to automatically notify your customers ahead of time before their payments are due to be processed, or if their payments are overdue, as a result of failed payments, all without the need of expensive 3rd-party services.

ThriveCart gives you the power to use your own methods of notification (such as through your own emails via your autoresponder) or use the built-in functionality.

1. Using ThriveCart’s payment notifications

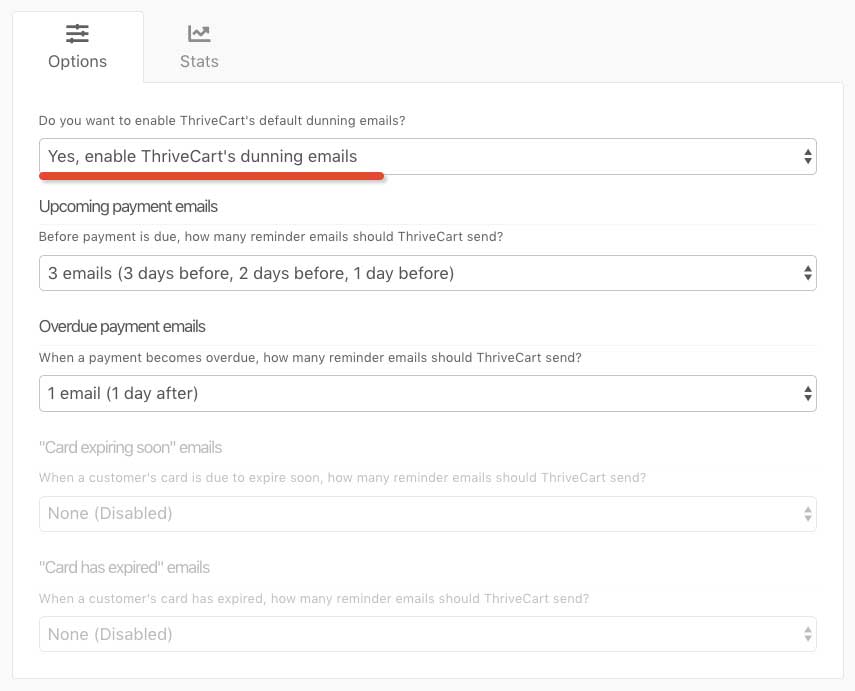

Under your Settings > Manage dunning area, you’ll want to enable ThriveCart’s dunning emails.

Under this area are two options for upcoming and overdue payments.

This allows you to set global automated reminders to your customers before their payment is due and after their payment is due to be processed.

ThriveCart’s built-in functionality allows you to set multiple reminders (up to 3) in the following ways:

- 1 Reminder: 1 day before/after a payment is due

- 2 Reminders: 2 days before/after a payment is due & 1 day

- 3 Reminders: 3 days before/after a payment is due, 2 days, and then 1 day

- None (disabled)

The “None” option allows you to set only specific reminders, so if you didn’t want to notify the customer when their payment is overdue and only when it’s coming up, you could disable those specific reminder emails.

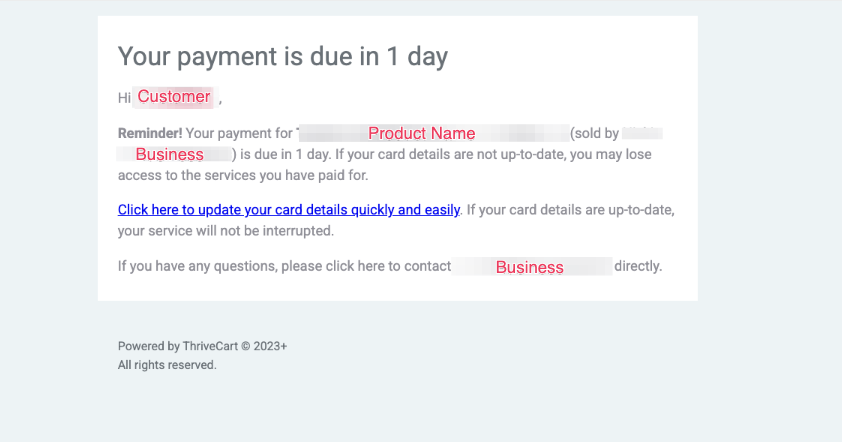

What do the built-in notifications contain?

Our built-in notifications are clean and professional. We clearly remind customers when their card is due to expire (or how long it’s been expired) along with your product name, your business name, and an auto-login link to your customer hub so they can update their details. We also provide a link to email or be taken to your support area (based on the support email/URL set within your product settings).

If your product is set to use a specific language, the system will send these messages out in the language you’ve chosen. You can edit and create custom translations should you wish to change the built-in messaging.

You can see examples for each of these notification types below:

Upcoming payment alerts

Subject: Your payment is due in {days} days

Hi {customer_firstname}

Your payment for {item_name} (sold by {vendor_name}) is due in {days} days. If your card

details are not up-to-date, you may lose access to the services you have paid for.Click here to update your card details quickly and easily. If your card details are up-to-date, your service will not be interrupted.

If you have any questions, please click here to contact {vendor_name} directly.

Overdue payment reminders

Subject: Your payment is {days} days overdue

Hi {customer_firstname},

Final reminder! Your payment for {item_name} (sold by {vendor_name}) is overdue by {days} days. If you do not update your card details, you may lose access to the services you have paid for.

Click here to update your card details quickly and easily. If your card details are up-to-date, your service will not be interrupted.

If you have any questions, please click here to contact {vendor_name} directly.

Email Variables

- {customer_firstname} will be replaced with the customer’s first name as saved on their transaction

- {days} will be replaced with the number of days appropriate to the specific notification

- [item_name} will be replaced by the product name that the customer purchased

- {vendor_name} will be replaced by either your business name or your own name (depending on what is set in your profile)

- The support link will take the user to the website or email as entered in your product’s settings in the support field

2. Using your own custom notifications

If you don’t want to use ThriveCart’s built-in notifications, you can set up your own notifications using your product’s individual automation rules. This allows you to set different notifications for different products!

Under your product’s automation rules (see this article for more details on product automation rules), you’ll have some new triggers under the Dunning section, including:

- When a payment is upcoming

- When a payment is overdue

When selecting these options, you can then enter the specific number of days before/after this rule will trigger.

You can then select the service you want to trigger, such as your autoresponder so you can add the customer to a tag or automation to send your own custom follow-up email sequence. Remember, you can get your customer hub URL from your account-wide settings area too.

Or you can use integrations like Google Sheets and Slack if you want to collate this information and/or have a more personal follow- up/let your team know about a customer’s upcoming card payment.

For example, you may have an annual subscription and you want to remind your customers 7 days ahead of their rebill. You can easily add your customers to a campaign in your autoresponder to trigger this.

3. Using your payment gateway notifications

Within Stripe

- Within your Stripe dashboard click Billing > Revenue Recovery.

- Select the “Emails” tab.

- From here you can enable emails when cart payments or bank debit payments fail, as well as card expiry emails.

Within PayPal

- To access the Configure Customer Email page, navigate to Service Settings -> Recurring Billing -> Customer Email.

- Click the Email Payment Failure Notification to Customers checkbox. PayPal emails a notice whenever a recurring billing payment fails. The message is sent only once per payment period, regardless of how many transactions failed in attempting to process payment.

- In the Payment Failure Sender field, enter the email address from which the messages should originate. This is typically the email address of someone in your organization who can provide support.

- You have the option of specifying text to appear at the beginning (Header) and end (Footer) of the email message.

- Click Submit to save and start sending emails when payments fail.

Frequently Asked Questions (FAQs)

- Q: Can I edit the content of the ThriveCart system emails?

- A: You can adjust the text of the ThriveCart system emails, but adjusting the colors or branding of these emails is not currently possible. To adjust the text, you’ll want to create or edit your Custom Text & Translation language profile by heading to Settings > Custom Text & Translation. See more on setting a translation here, just make sure to then apply your custom translation to your product(s)!

- Q: Where can I confirm that a dunning email was sent?

- A: We do not currently provide a send log for dunning emails within your dashboard. If your customer claims to have not received an email, first have them check their spam/trash folders in their email inbox, but you can reach out to the support team for them to check email send logs (within 45 days of email send).