What is a W8-BEN and W9 Form?

The W8-BEN and W9 forms are typically for USA based vendors, who are usually required to collect the W9 forms from their national affiliates and W8-BEN forms from their International affiliates for affiliate tax compliance with the IRS.

If you’re not an American-based company, then generally you don’t need to request this from your affiliates. However, if you’re unsure, then please speak to your financial professional.

If you are a US Based business, it would be your responsibility to check the form the affiliate submits, then approve or decline (with an optional message) the affiliate from promoting your product.

Enabling W9 & W8-BEN form collection

To set this as a requirement for affiliates to complete when applying to promote your products you’ll need to edit the requested fields on your sign up page.

You can do this from your Affiliates > Product options area. Then selecting the Manage button for the product you want to set this for.

From the dropdown, click Edit signup page.

In the modal window that opens, you’ll want to click the button for Edit requested fields.

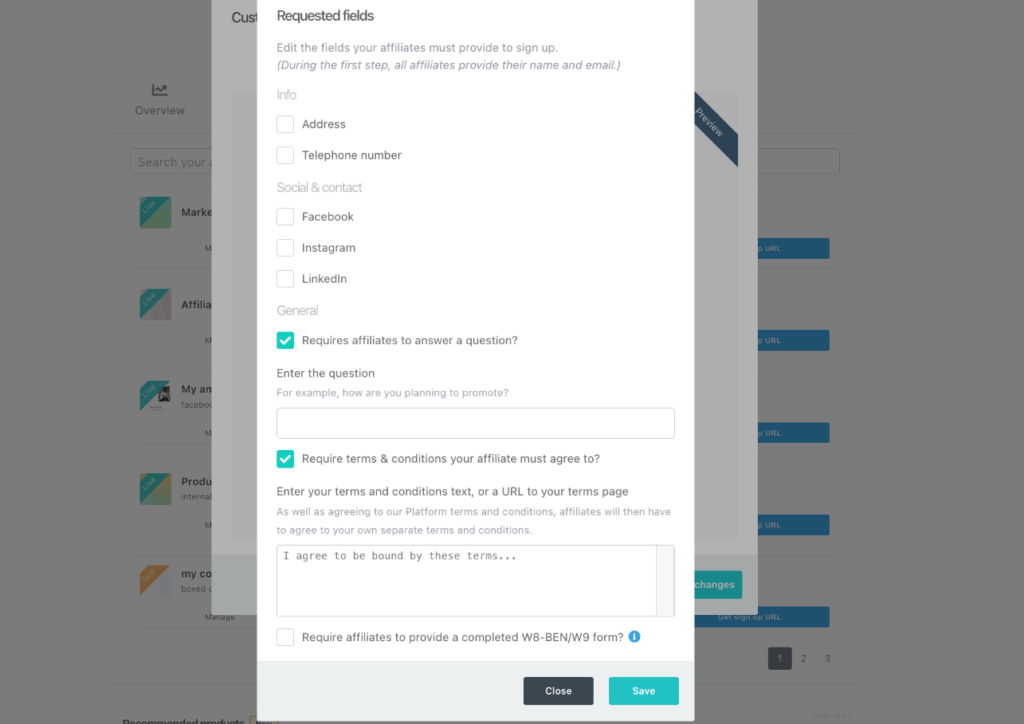

This will then launch some further options. At the very bottom, you can select the checkbox for the collection of W8-BED/W9 forms.

To see more information about requesting information from your affiliates on signup, see our help desk article here.

What happens when I request this from an affiliate

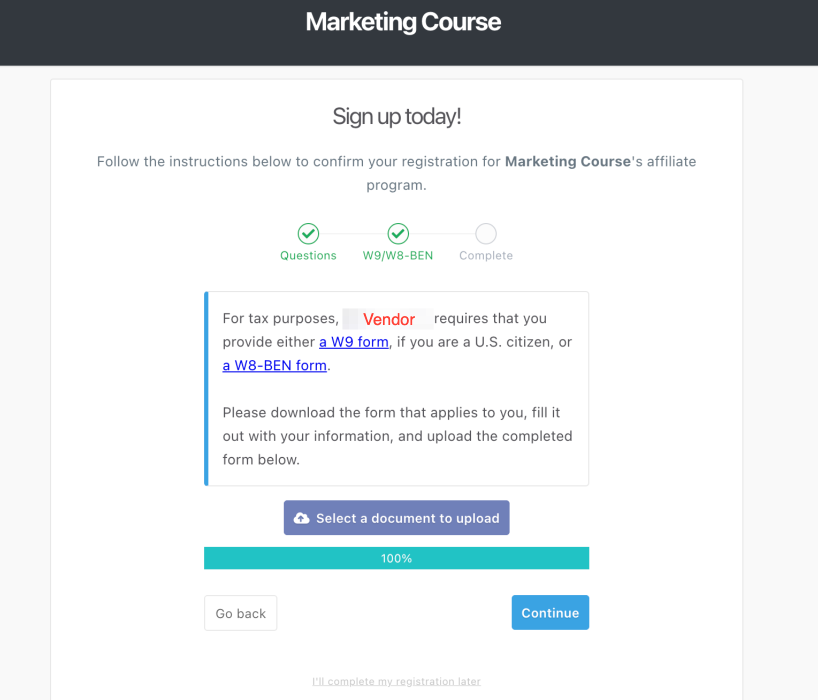

When an affiliate is going through the sign-up process they will be requested to upload their completed copy of their required form. There are links to the US Governments website for the forms, making it as easy as possible for your affiliates to complete them.

Once the form has been downloaded, saved, and completed the affiliate can upload the form as part of their affiliate application. If they can’t do this immediately, they can complete the registration for your product at a later date. (They will not be able to promote until this is completed).

The upload is required to be a PDF or DOC file, but the document is not verified by the system.

If you’re collecting a W9/W8 form then affiliates will need to be manually approved.

If your product was set up to automatically approve affiliates, then this will be overridden when the request for W8/W9 form collection is enabled.

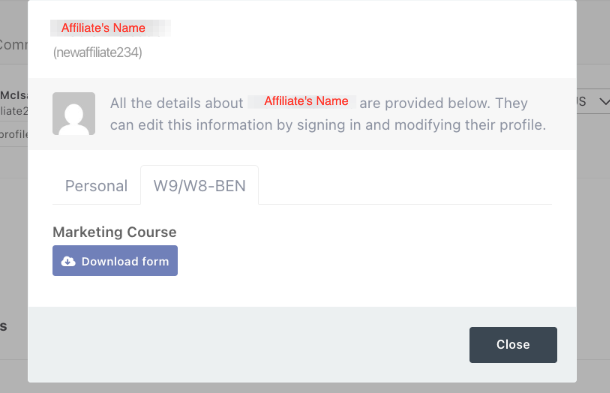

When you go to approve them, or when you view their profile, it will give you the ability to download the form and then make your decision once you’ve assessed the form.

Disclaimer:

Please note, we (ThriveCart) cannot offer financial or tax advice. This sort of thing is something you need to check with your financial professional as every case varies.

We offer the features to be able to do this quickly and easily SHOULD you need to, but we do not offer a professional service to confirm whether you, in your specific circumstance, do need to do this or not, as a business.

Our platform makes it easy, should you need to do it. Your financial adviser will confirm whether you do need to or not.

As a general rule, however, if you are a US-based business, to prove affiliate commissions are not taxable income for you,(And therefore something you would pay tax on otherwise) you would require a W9 form to be completed for US-based affiliates or a W8-BEN form to be completed for affiliates who are located internationally. (Not in the US)

Companies outside the US should not generally need to worry about using these forms as they are tax forms for US-based companies.