If you’re charging sales tax on your products and services, you may wish to enable EU VAT ID verification.

This allows registered businesses in the EU the ability to enter their VAT ID so that the tax can be zero-rated at the checkout where applicable.

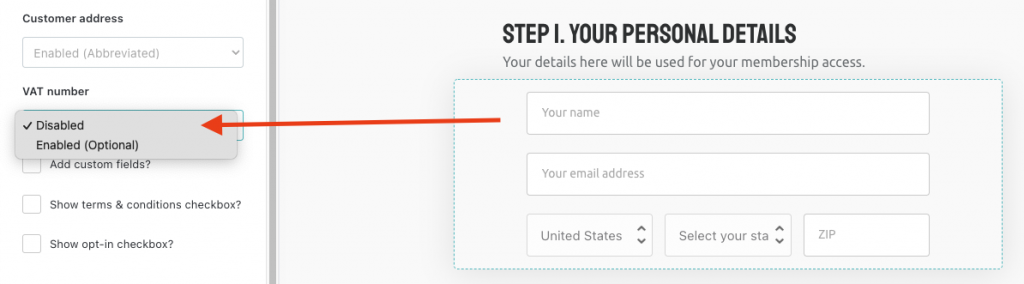

You can do this from the product’s Checkout editor.

(If you don’t see the option for the VAT number in the editor, it’ll be because your product hasn’t got sales tax enabled. See here on how to enable this).

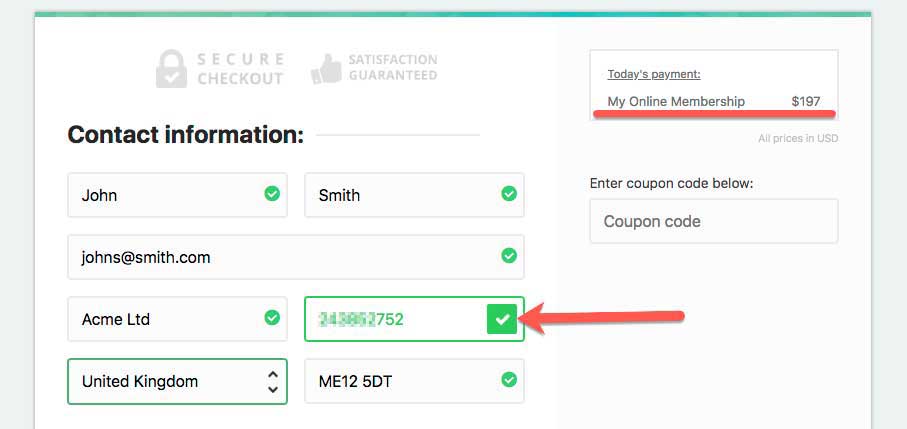

So now, when a customer lands on your checkout from a country in the EU an optional field will be shown requesting their VAT Number. By default sales tax will be applied to your product, but if the customer enters a number into the VAT number field, the system will verify this is a valid VAT ID for their country and then remove (zero-rate) the sales tax on the cart.

After entering a valid VAT number for their country, the sales tax will be removed from the order.

Things to note;

- ThriveCart will only display this field on your checkout page when applicable. If your customer is based outside of the EU, this field will not show as it’s not relevant.

- If ‘sales tax’ is not enabled on your product, this field won’t be an option in the editor.

- The system checks to make sure that the VAT ID is valid to the country of the customer and that it’s a valid VAT ID. This prevents users from entering random numbers into the checkout.

- If the VAT is zero-rated this is broken down on the invoice receipt and notice of EU Reverse VAT Charge is indicated.

If you have any questions, feel free to contact us directly