Managing taxes across borders shouldn’t slow your growth. ThriveCart handles global sales tax automatically so you can simplify global tax compliance with ThriveCart Pro+ Tax Management, powered by TaxJar.

From digital creators to ecommerce brands, it’s built to keep every checkout compliant and every sale effortless. ThriveCart’s automated tax calculation will calculate and collect the correct sales tax, accurately, and transparently, so you can focus on selling, not spreadsheets.

Supported Regions

ThriveCart currently supports automated tax calculation in the following countries and regions:

- USA

- Canada

- The EU

- Some non-EU countries like the UK, Switzerland, Norway, and Liechtenstein

- Australia

- New Zealand

- Chile

- Mexico

ThriveCart Sales Tax Setup

Sales tax regulations can be complex and vary by region. With ThriveCart Pro+, you can:

- Collect sales tax automatically across supported countries and regions.

- Apply correct rates based on customer and vendor location.

- Display tax breakdowns clearly on checkout pages and receipts.

- Stay compliant globally without extra fees or manual setup.

ThriveCart Simple Sales Tax, calculates applicable rates dynamically and adds them to your product pricing during checkout.

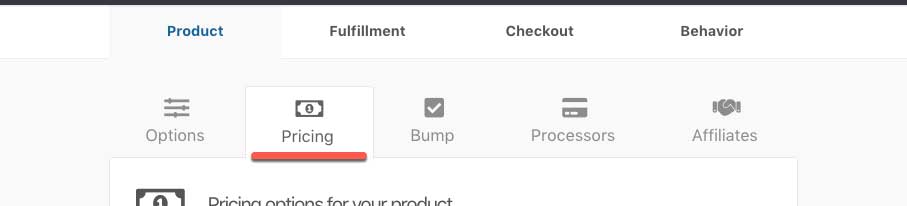

To enable sales tax collection on your checkout, this is done on the individual product-level under Product > Pricing. This allows you to have different settings per product and choose how and which products are charging customers digital sales tax.

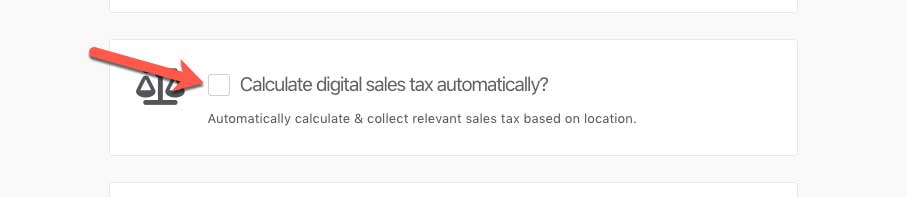

You’ll then want to tick the checkbox to Calculate digital sales tax automatically.

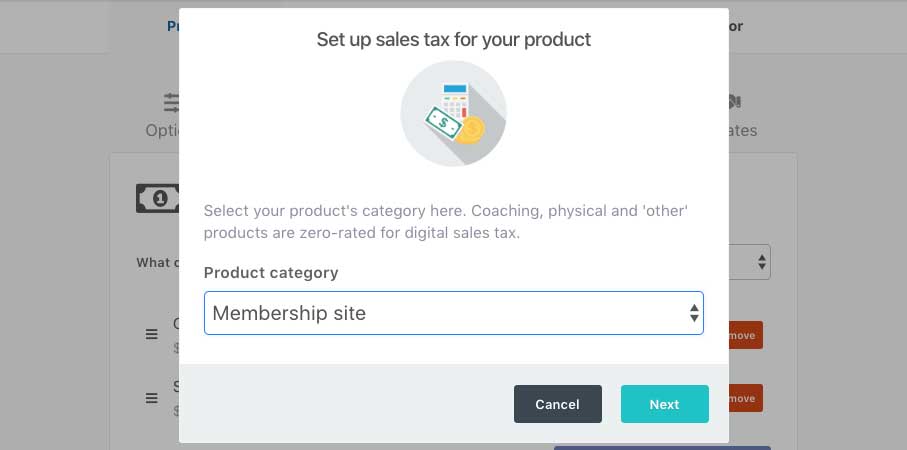

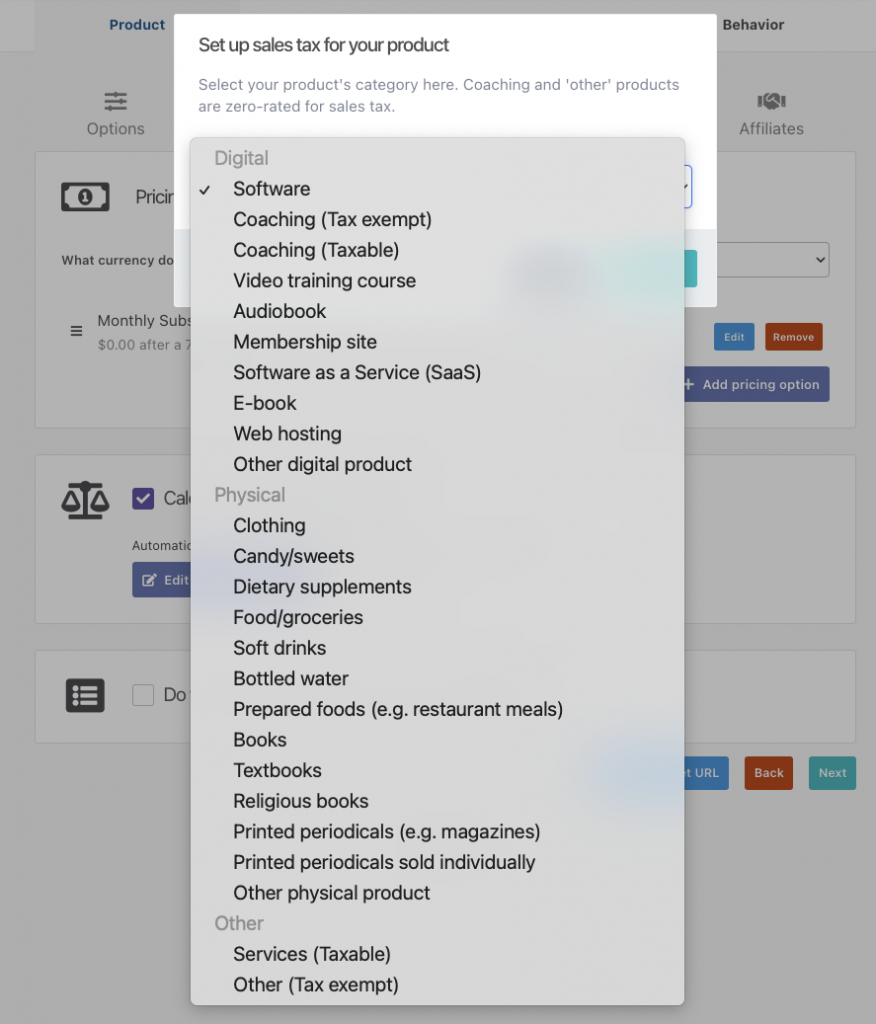

After enabling this option a modal window will appear where you can select the product category.

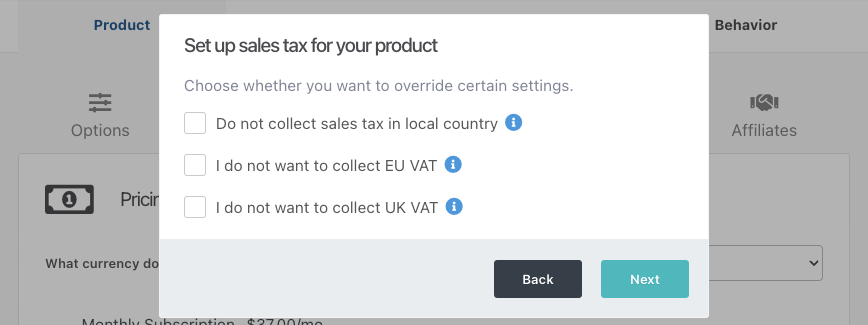

After choosing your sales tax category, you’ll have a couple more options such as the ability to disable sales tax collection in your own country, or if you don’t want to collect EU Digital sales tax.

If you are not sure if you should be disabling sales tax in your local country or disabling the collection of EU Digital Sales tax, we recommend speaking to your local tax authority for advice.

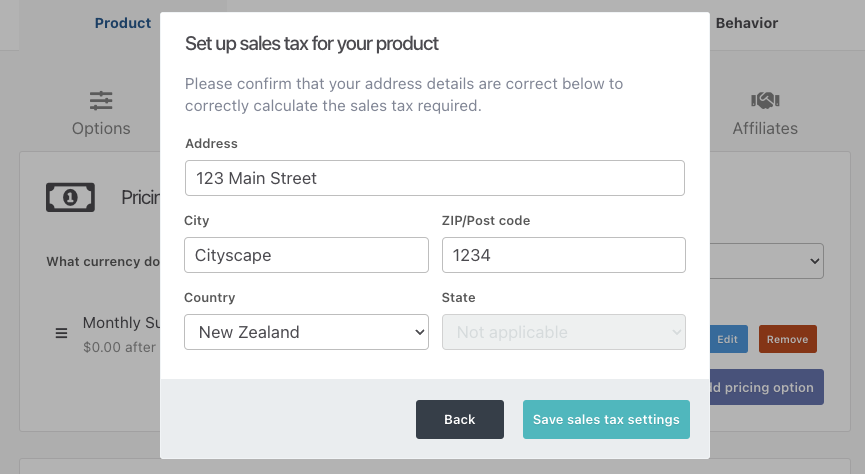

Finally, you’ll need to confirm your address information used for sales tax calculation. Digital sales tax is often calculated using 3 bits of information; the product type, your customer’s location, and your location. Here you will confirm your location.

Set Tax-Inclusive Pricing

It’s worth noting that our default sales tax collection setup will calculate and add taxes onto the product price. With tax-inclusive pricing, the product price you set would be the final price that the customer pays and taxes calculated in the backend.

See more on setting tax-inclusive pricing in our guide here.

Create Tax Profiles for Inclusive/Exclusive Pricing

You can create and edit tax profiles inside your account-wide tax settings, to set inclusive/exclusive tax rules and assign countries that should be excluded from that rule.

Settings → Account-wide settings → Finances → Tax

For example, you may want to collect sales taxes inclusive to the product price for the majority of your customers (i.e. throughout the EU), but exclude taxes for customers in certain countries (i.e. Canada, United States).

See more on creating sales tax profiles in our guide here.

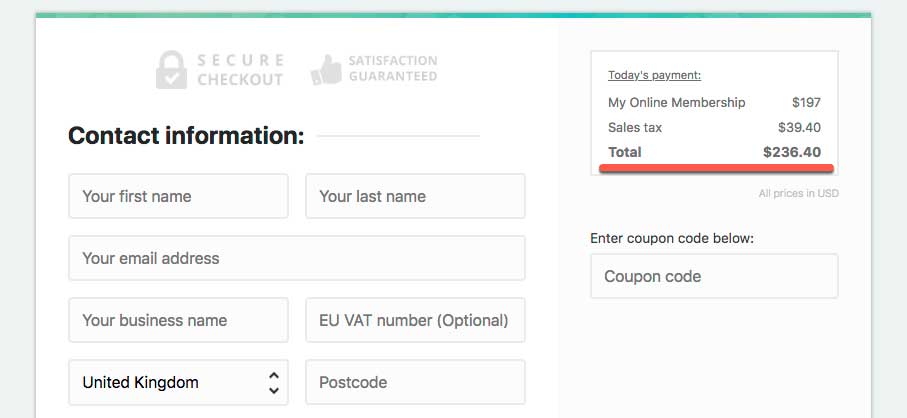

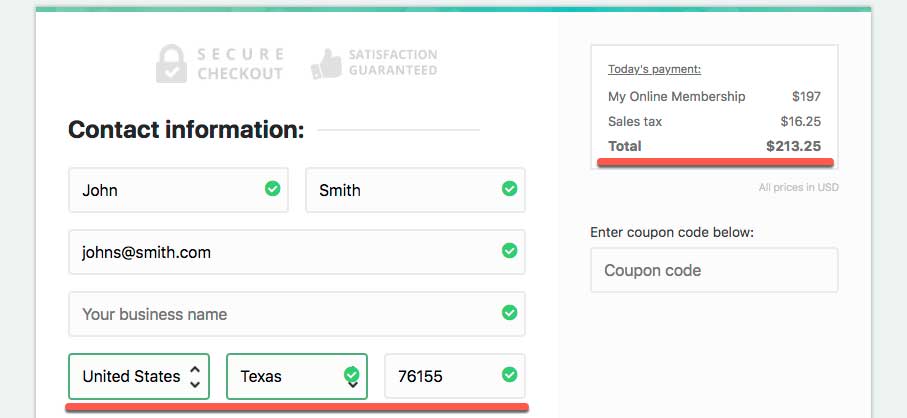

Sales tax presented in checkout

Now that you’ve completed your sales tax settings, you can choose to collect the customer’s full address or abbreviated address (country, state (if US/Canada), and Zip/Postcode). You set which address fields you want to collect under the Checkout > Customize > Edit requested fields section.

Now, when a customer lands on your checkout if their country uses a flat-rate digital sales tax (like the EU), this will automatically be added and applied to the order when they land on the checkout.

If your customer is based outside of the EU, then digital sales tax will be added based on the product type, their location, and your location, and only if it’s legally required.

ThriveCart supports both physical and digital sales tax.

EU VAT Collection Notes:

Selling to businesses in the EU? Remember you can also enable the EU VAT ID field which will verify their VAT ID and zero-rate tax for EU customers where applicable.

Wanting to know what rate of VAT will be charged to your customers (i.e. their local rate or your local rate)? This is managed by the tax category option in the dropdown here:

The product category you choose here will determine how EU VAT collection is calculated.

- Digital – setting digital product tax settings will apply VAT based on the customer’s location

- Physical – will apply VAT based on the vendor’s location

Choosing Other Digital Product or Other Physical Product will also ensure the primary VAT rate is used (not any potential lower VAT rates).

Let’s look at an example:

You’re a vendor in the France and you’re selling a digital membership platform and you want customers in the EU to be charged 20% VAT (your local rate) and not the local rate of your customers. You would set the product category to “Other Physical Product”.

Even though you’re selling a digital product, it’s the category here that determines how VAT is added to your customer’s order. Choosing a tax category under Digital will charge tax on your customer’s location which is why you would typically need to charge once you reach certain sales thresholds. Speak to your local tax authority for your specific requirements on what VAT rate should be charged to your customers.

1st January 2021 Brexit notes:

With the UK leaving the EU coming into effect on the 1st of January 2021, the UK will no longer be considered as part of the EU within the platform. This means the above information won’t be applicable for UK vendors and sales to the UK.

For example, if you’re a vendor based in the UK and disable ‘collect EU VAT’ from your tax settings when enabling sales tax, you’ll still collect your local VAT but any sales to the EU will not have taxes added.

VAT ID Verification for UK businesses is now managed through the HMRC’s VAT ID system (EU VAT ID’s are still verified through the VIES system). The EU’s reverse charge system still operates for international sales with a valid VAT ID.

Previously if you were earning less than €10,000 and selling to the EU you could collect VAT at your local rate before changing to the customer’s local rate for digital products. As the UK is no longer a member of the EU this VAt MOSS threshold no longer applies [source].

If you’re selling digital products or services to British customers, you need to register for UK VAT as of 1 January, full stop. You are not allowed to sell digital products to UK consumers (aka private individuals) if you’re not registered for UK VAT. There is no tax registration threshold for your business. [source].

For a breakdown on how post-Brexit taxes are calculated see the following:

- Physical tax from the UK to EU = no tax applied

- Physical tax from the EU to UK = UK VAT applied as required on imports

- Physical tax from the EU to EU = continues to be based on vendor location

- Physical tax from non-EU to UK = continues to have no VAT added at purchase

- Physical tax from non-EU to EU = continues to have no VAT added at purchase

- digital products from the UK to EU = customers location used to apply tax

- digital products from the EU to UK = customers location used to apply tax

- digital products from the EU to EU = customers location used to apply tax

- digital products from non-EU to UK = customers location used to apply tax

- digital products from non-EU to EU = customers location used to apply tax

- services category from the UK to EU = UK VAT rate applied

- services category from the EU to UK = Vendor’s local VAT rate applied

- services category from the UK/EU to non-UK/EU = Vendor’s local VAT rate applied

Canada GST/HST/PST Setup:

Canada has various tax types available in different provinces, GST, HST, PST, QST, and RST. Within ThriveCart, the tax category you select will determine what taxes are collected from your customers in their provinces.

- Some categories will provide an HST/PST type exemption (where applicable), charging a flat 5% GST across all provinces

- The “other digital/physical product’ categories will charge full tax rates in provinces.

- The “Services (taxable)” option under other, will charge GST/HST where applicable, but not PST, RST, or QST (this is typically suited for HST province-based vendors).

Frequently Asked Questions (FAQs)

- Q: How do I enable sales tax collection for my products?

- A: Go to Product > Pricing in your ThriveCart dashboard, tick the box for “Calculate digital sales tax automatically,” select your product category, and confirm your location.

- Q: Can I disable sales tax collection in my own country or the EU?

- A: Yes, during setup you can choose to disable sales tax collection in your country or for EU digital sales tax. It’s best to check with a tax professional before disabling.

- A: Yes, during setup you can choose to disable sales tax collection in your country or for EU digital sales tax. It’s best to check with a tax professional before disabling.

- Q: How does ThriveCart calculate the correct sales tax?

- A: It uses your product type, your customer’s location, and your business location to apply the right tax rates dynamically.

- A: It uses your product type, your customer’s location, and your business location to apply the right tax rates dynamically.

- Q: Can I set a physical nexus in another state to collect additional state taxes?

- A: No, ThriveCart supports only a single sales tax nexus. There are options, however:

- You could connect Quaderno to set additional physical sales tax nexus states.

- If you’re doing a one-off physical event out-of-state, you could set a client or sub-user account as the product owner (see more here), making sure to adjust their address to that state. Purchases of this product would then have taxes calculated based on the address of that product owner.

- A: No, ThriveCart supports only a single sales tax nexus. There are options, however:

- Q: Sales taxes aren’t being collected correctly, why?

- A: You’ll want to review the product type that you’ve set in checkout. For example, digital sales tax products would use the customer’s location and the tax rules of their country/state. Some product types (such as ebooks or physical books) have a reduced sales tax amount set by that customer’s country/region.

Whereas physical products would charge taxes based on your location, as long as customers are within your same country/state.

If you’re not sure why taxes are/aren’t being calculated on a checkout, feel free to reach out to our support team with your example checkout and they can help review your product setup with you.

- A: You’ll want to review the product type that you’ve set in checkout. For example, digital sales tax products would use the customer’s location and the tax rules of their country/state. Some product types (such as ebooks or physical books) have a reduced sales tax amount set by that customer’s country/region.

- Q: Can I set specific rates to be charged at checkout?

- A: No, within ThriveCart it’s not currently possible to set a standard sales tax percentage. However, you can integrate with Quaderno to set tax profiles that better suit your business, as Quaderno would then calculate taxes in checkout.

- Q: How can I exclude certain countries from tax-inclusive pricing?

- A: Using tax profiles you can set a default tax rule, and then search and assign countries to be excluded from that rule. See more here.

Related Articles

- Generating sales tax reports

- EU VAT number validation

- Tax-Inclusive Pricing

- Using Tax Profiles to Apply Tax Based on Customer Location

- What are “ThriveCart Application Fees”, and Why it’s Not Additional Charges

- Recurring Revenue Upgrades (automatic subscription cancellation)

- Quaderno Integration

Need Tax Help?

Please note that our support team cannot offer tax advice specific to your business as we’re not a registered tax authority, but we can help clarify any specific setup within the platform.