Managing sales tax doesn’t have to be complicated. With our Quaderno integration, ThriveCart users on Lifetime, Client, Pro, and Pro+ plans can automate tax handling across products in just a few clicks. From global compliance to country-specific rules like Spain’s Verifactu, this integration ensures invoices automatically include both customer and merchant tax IDs, helping you stay compliant, avoid rejections, and save time on manual admin.

How to Connect Quaderno for Sales Tax Management

IIf you already have a Quaderno account and want to connect it to ThriveCart, this sales tax automation tool makes it easy to manage your product’s tax setup. The good news is—you can do it quickly on your eligible plan with just a few clicks:

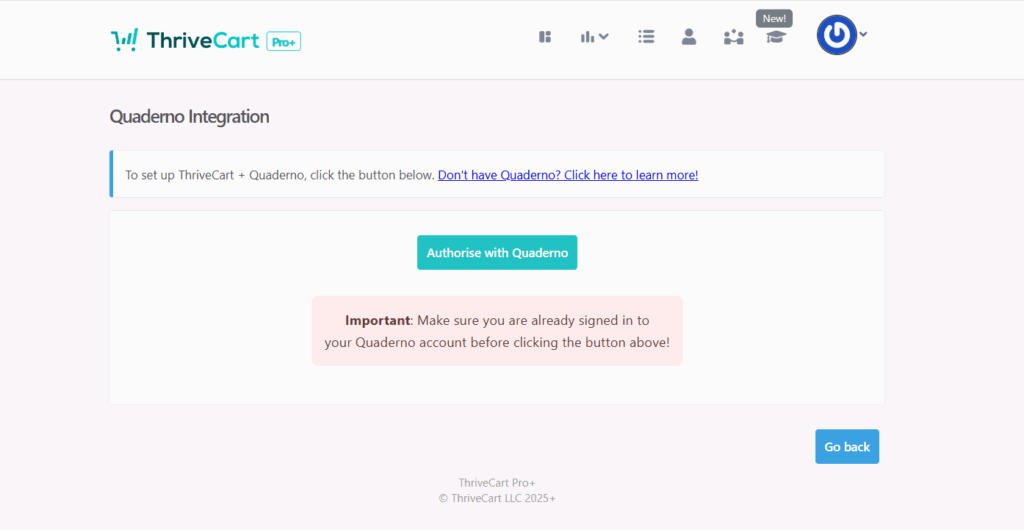

Before you begin, make sure you are logged in to your Quaderno account.

Step 1: Connect Quaderno to ThriveCart

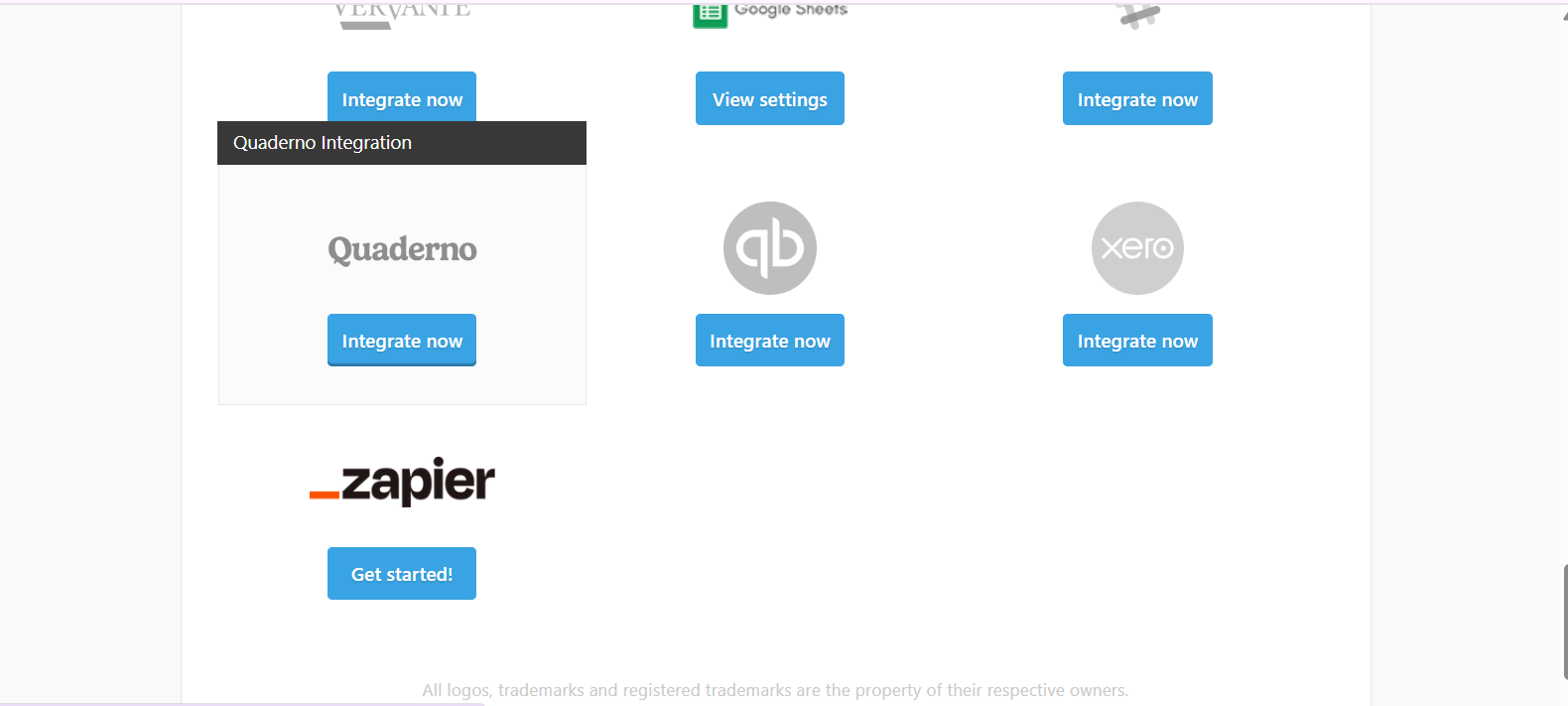

- In your ThriveCart dashboard, go to Profile > Integrations.

- Scroll down to Quaderno and click Integrate Now.

- Click Authorise with Quaderno.

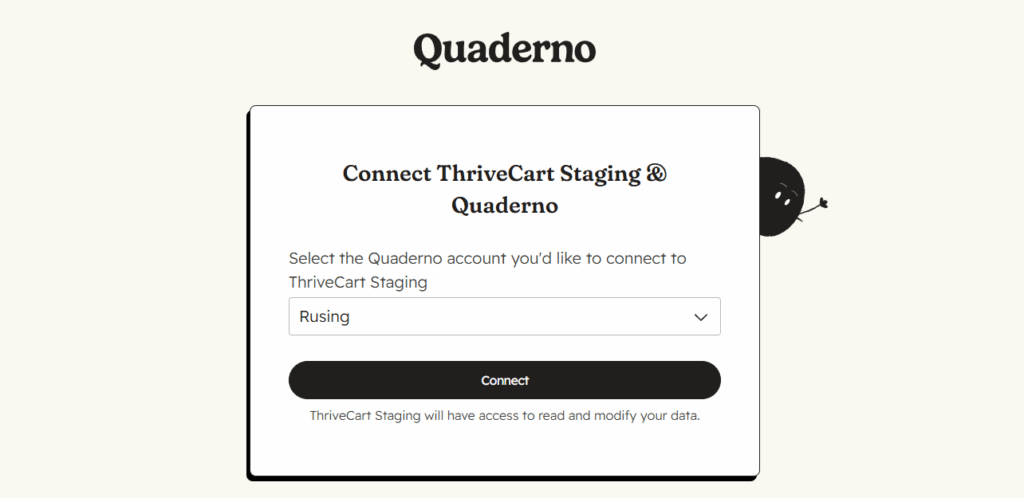

- Choose your Quaderno account, then click Connect.

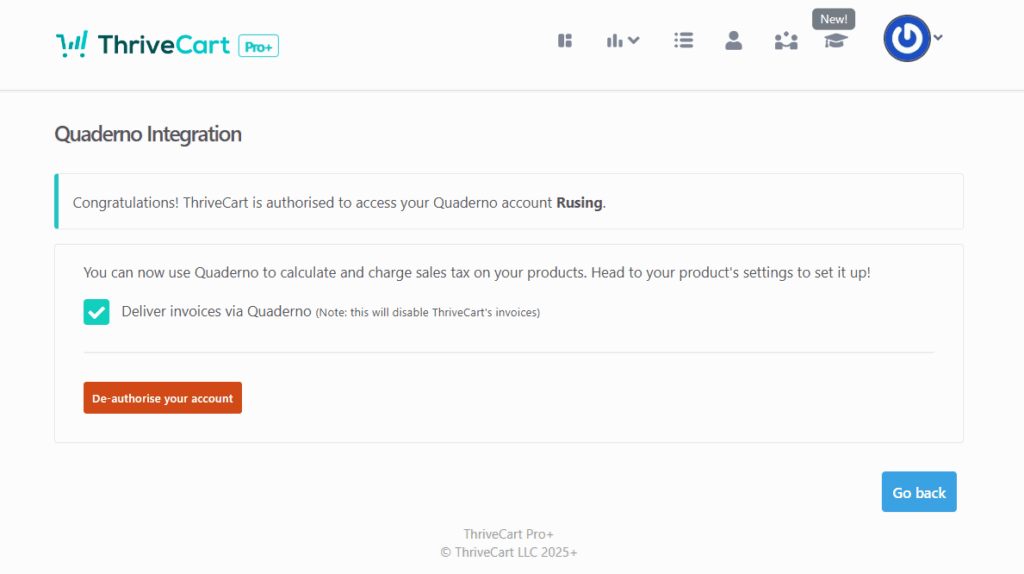

- Once complete, you’ll be redirected back to ThriveCart, and the integration will be active.

Step 2: Enable Quaderno on Your Product

- Go to your Product list and click Edit on the product you want to update.

- Navigate to the Pricing tab and scroll to the Sales Tax settings.

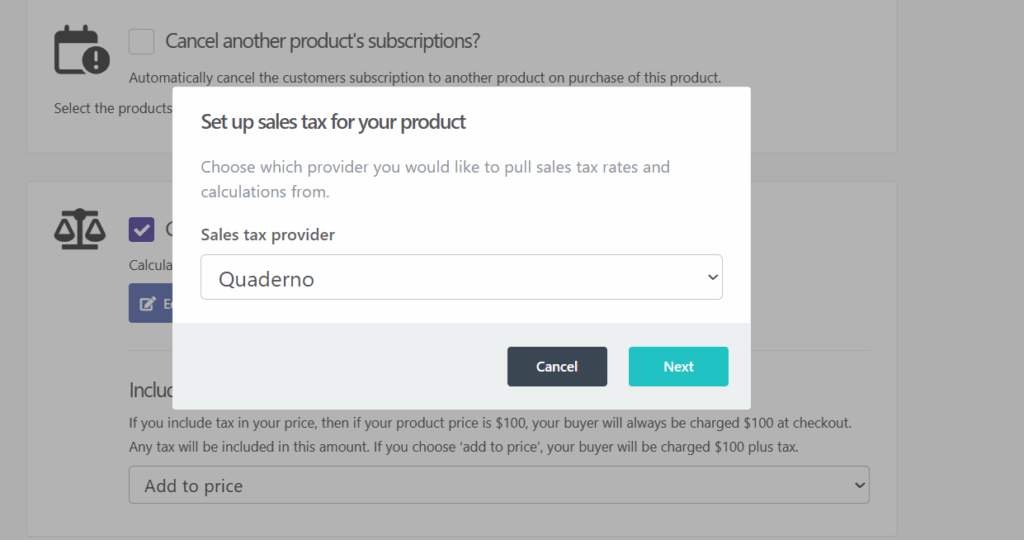

- In the modal, select Quaderno, then click Next.

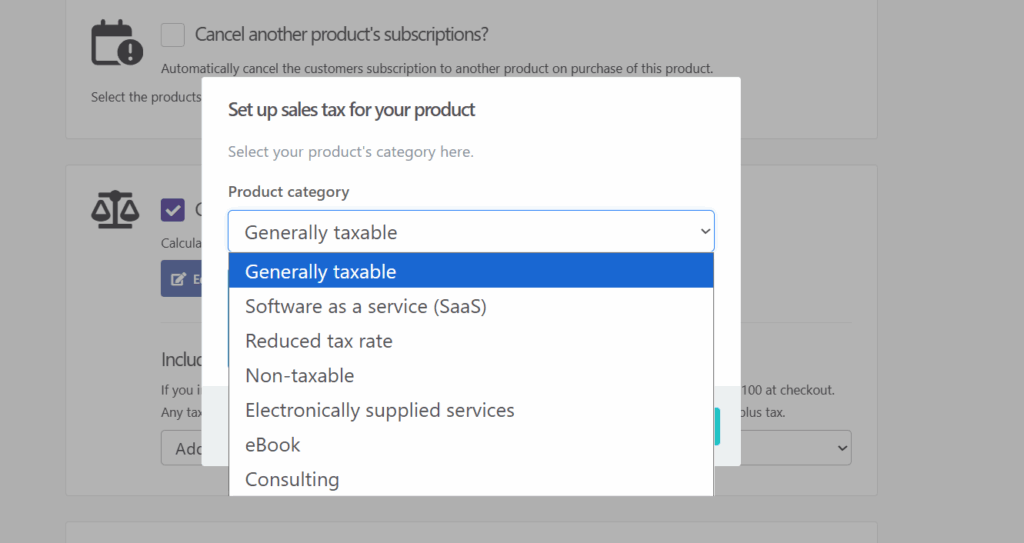

- Choose your product category.

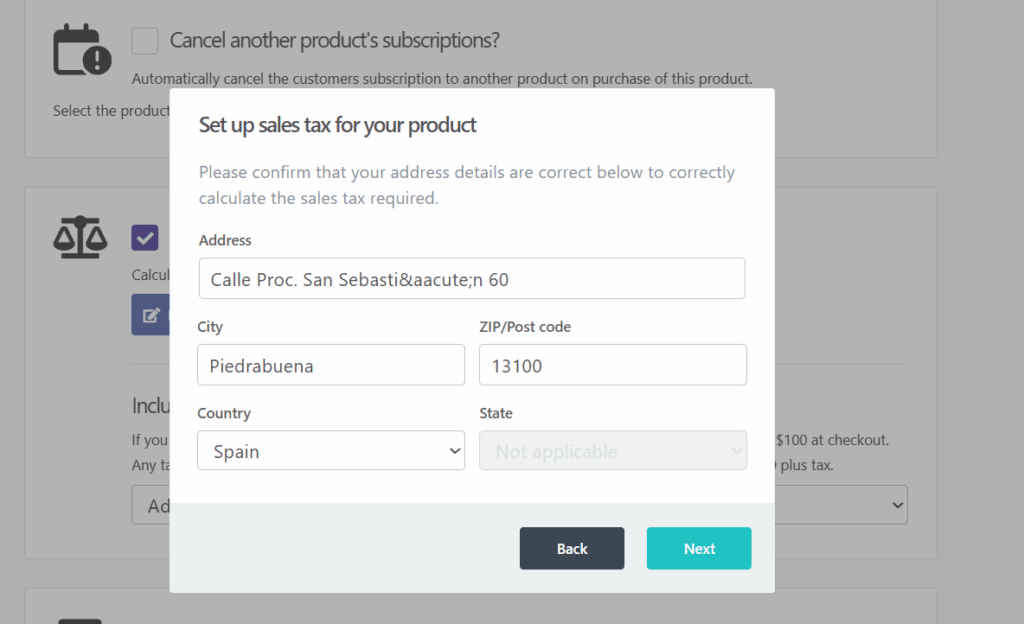

- Enter your address details then click Next.

- Finally, click Save and Get URL to complete the setup.

That’s it! Your product is now set up to use Quaderno for sales tax management, making compliance smooth and automated right within ThriveCart.

Any rules set within your Quaderno account will be used on your product’s checkout, and customer data automatically sent to Quaderno for invoicing.

Frequently Asked Questions (FAQs)

- Q: Who can use the Quaderno integration ?

- A: The ThriveCart Quaderno Integration is available to users on our Client, Pro, and Pro+ ThriveCart plans.

- Q: Does ThriveCart handle Verifactu requirements automatically?

- A: Yes, thanks to our Quaderno integration, ThriveCart Verifactu Compliance is handled automatically, ensuring valid Tax IDs are always included on invoices.

- Q: What happens if a required tax ID is missing for a Spanish customer?

- A: ThriveCart automatically injects the required CIF/NIF fields in your checkout. Customers from Spain purchasing from Spanish vendors using Quaderno MUST provide a valid tax ID (CIF or NIF) to complete checkout. The checkout form will not submit without it, ensuring Verifactu compliance is enforced at the point of sale.

- Q: Can I enable Quaderno for specific products only?

- A: Yes. need to enable Quaderno on a per-product basis from the product’s Pricing > Sales Tax settings.

- Q: Can I set up regional tax handling in the U.S.?

- A: Yes, Quaderno gives you full control over product tax handling in the USA with custom settings per product and per state.

- Q: Why aren’t my invoices sending/why are customers receiving two invoices?

- A: It’s worth noting that ThriveCart will automatically send customers receipts after their purchases. This can be disabled at an account level (under Settings > Account-wide Settings > Finances), or by unchecking the box on each product’s pricing options.

Quaderno will automatically invoice customers based on the information passed through after their order is complete, as long as your account has this setting enabled. Troubleshooting Quaderno invoices will need to be done with Quaderno Support directly.

- A: It’s worth noting that ThriveCart will automatically send customers receipts after their purchases. This can be disabled at an account level (under Settings > Account-wide Settings > Finances), or by unchecking the box on each product’s pricing options.