ThriveCart’s botnet protection and anti-fraud systems are designed to block automated attacks before they ever reach your payment processor. One of the most effective layers in this defense is Captcha.

By keeping Captcha enabled on your checkouts, you dramatically reduce the risk of card testing, scripted checkout spam, and other automated abuse—helping you prevent fraudulent purchases without sacrificing a smooth experience for legitimate customers.

What does Captcha look like in checkout?

Captcha is presented adaptively during checkout to block automated abuse without adding unnecessary friction for real customers. Most buyers won’t see a challenge at all; it only surfaces it when risk signals suggest bot activity (for example, high-velocity attempts, suspicious device patterns, or known card-testing behaviors).

When triggered, the buyer completes a quick human-verification step (for example a simple image challenge such as “click all images with bikes”) before they can submit payment. This keeps legitimate checkouts smooth while filtering scripted transactions and card-testing bots upstream, before they ever reach your payment processor.

How does Captcha play into ThriveCart fraud prevention?

- Captcha is a critical layer that filters automated traffic before it can test stolen cards or overwhelm your checkout.

- Botnet protection: Captcha disrupts high-volume, distributed bot attacks that can attempt thousands of transactions in seconds.

- Anti-fraud systems: Together with rate-limiting, device fingerprinting signals, and behavioral checks, Captcha adds a high-confidence signal that a real human is completing the checkout.

- Prevent fraudulent purchases: Fewer successful card tests mean fewer chargebacks, fewer processor flags, and less risk to your payment gateway reputation.

What is card testing—and why Captcha stops it

Card testing is when bad actors use bots to rapidly try stolen or generated card numbers on low-cost checkouts to see which cards “work.” Even failed attempts harm your business:

- They trigger processor and gateway risk reviews that can lead to higher fees or account holds.

- They inflate decline rates and pollute analytics.

- They can lead to successful fraudulent purchases that later become chargebacks.

Captcha breaks card testing workflows by requiring a human verification step. Bots that rely on scripts, headless browsers, or credential stuffing pipelines fail at this hurdle, dramatically reducing both the volume and success rate of attacks.

Manage Captcha settings

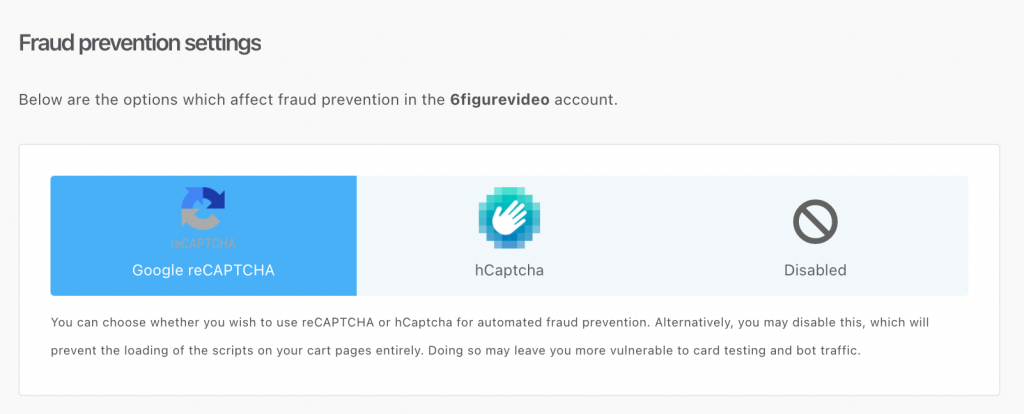

To manage your settings, simply head to your Settings > Account-wide settings > Fraud prevention settings area.

New accounts will have Google’s reCAPTCHA service enabled by default, but you can optionally change this to hCaptcha if you not want to share customer analytics and behavioral data with Google.

While we do not recommend it, you can also choose to completely disable this security feature.

These systems only trigger when customer behavior appears to be suspicious or fraudulent, and when triggered, your customer will see a standard ‘challenge’ to prove that they’re a human, non-automated user. This may be a standard request to ‘Click all of the images containing traffic lights’, or other simple tests.