Selling digital products or services to business customers across the European Union? ThriveCart’s intelligent EU VAT validation system takes the complexity out of international B2B transactions by automatically verifying VAT numbers and applying the correct tax treatment—right at checkout.

When you enable VAT number verification on your checkout pages, registered businesses throughout the EU can enter their VAT ID during purchase. ThriveCart instantly validates the ID against the official EU VIES database to confirm authenticity and ensure it matches the customer’s country.

Once verified, qualifying cross-border transactions are automatically processed using zero-rated tax through the EU’s reverse charge VAT mechanism—meaning VAT is removed from the transaction entirely and the tax responsibility shifts to the purchasing business.

How to set up ThriveCart EU VAT validation

You will first need to enable sales tax on your product and ensure that the sales tax location is set to an EU country.

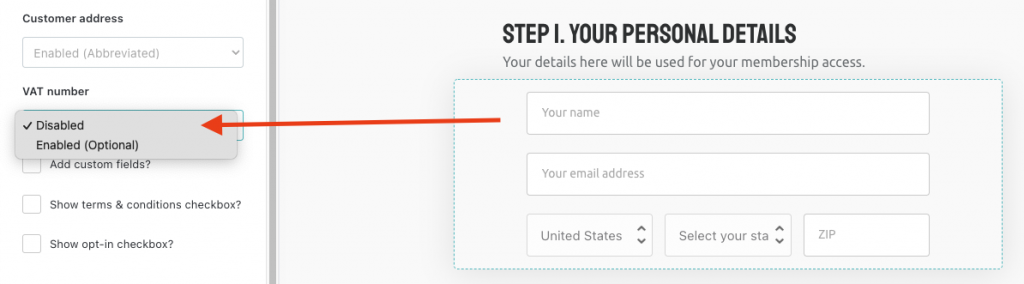

You can then enable the VAT number field within your product’s Checkout editor by heading to your products Checkout tab and clicking Launch Editor.

(If you do not see the above option for the VAT number field in the editor, it’ll be because your product does not have sales tax enabled. See here on how to enable this).

So now, when a customer lands on your checkout from a country in the EU an optional field will be shown requesting their VAT Number.

How this works in checkout

By default, sales tax will be applied to your product.

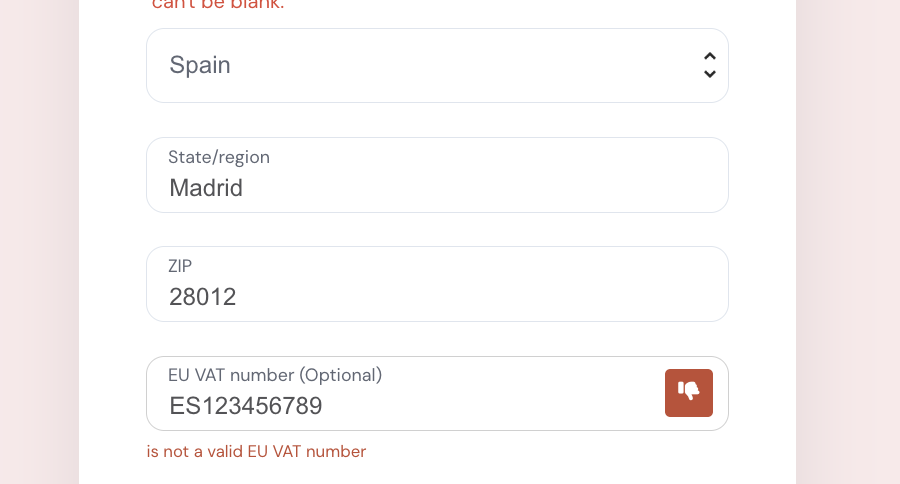

If the customer enters a number into the VAT number field, and clicks Apply, the system will automatically attempt to verify if this is a valid VAT ID for their country and then remove (zero-rate) the sales tax on the cart.

If the VAT ID cannot be verified, an error with the ID will be presented and taxes will not be zero-rated (however, the VAT ID will still be included on the customer’s invoice):

The way sales taxes are applied and shown in checkout differs depending on whether you are using exclusive (add-to-price) or inclusive sales taxes.

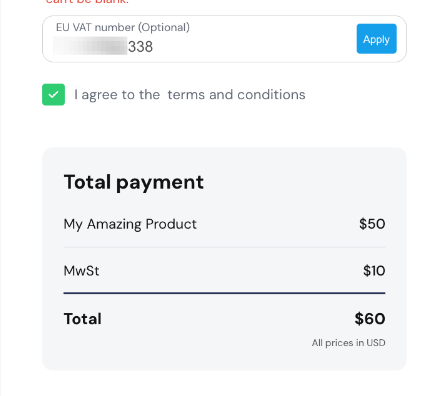

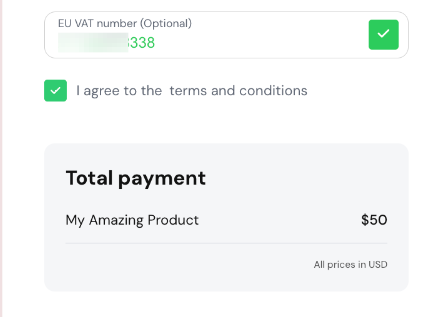

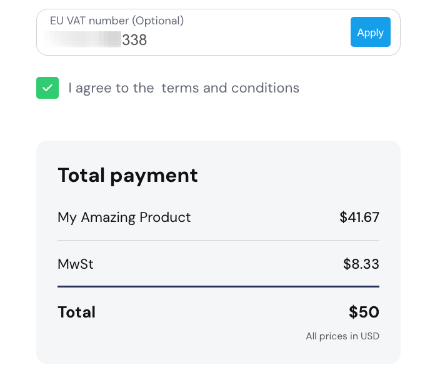

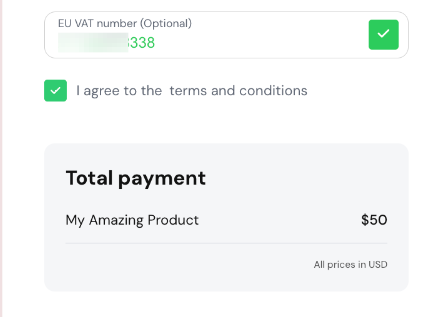

Exclusive sales taxes

The final amount that the customer pays will be adjusted as sales taxes are removed from the checkout. Before applying the VAT number, we can see that sales taxes are calculated and added to the total:

Once the VAT number is applied and validated, sales taxes are zero-rated and removed from the pricing summary:

Inclusive sales taxes

Sales taxes are calculated as part of the product price by default, but the product price itself does not change when zero-rating VAT.

Similar to when using Exclusive sales taxes, once the EU VAT number is applied, the line referencing sales taxes is removed from the pricing summary entirely.

Frequently Asked Questions (FAQs)

- Q: When does ThriveCart zero-rate VAT for reverse charge?

- A: VAT is automatically zero-rated when ALL of the following conditions are met:

- Your product has sales tax enabled

- You’ve enabled the EU VAT ID verification field in your Checkout Editor

- The customer is located in an EU country

- The customer enters a valid VAT ID for their country

- The transaction is cross-border (vendor and customer are in different EU countries)

- The VAT ID successfully validates against the VIES system

- A: VAT is automatically zero-rated when ALL of the following conditions are met:

- Q: Will the customer’s VAT ID appear on the invoice?

- A: Yes. When reverse charge is applied, the customer’s VAT ID is automatically saved to the order and appears on the invoice, along with reference to 0% VAT. If validation failed, the VAT ID will still be saved to the invoice, but the invoice will show standard VAT charges.

- Q: Why am I not seeing the VAT number field in the editor?

- A: Sales tax must be enabled on your product, and the location for sales tax calculation set to an EU country.

- Q: Will the VAT ID field show for all my customers?

- A: No. ThriveCart intelligently displays the VAT ID field only when relevant—specifically, when a customer’s location is detected as being in an EU country. Customers from the US, UK (post-Brexit), or other non-EU countries won’t see this field, keeping your checkout clean and streamlined.

- Q: Can I make the VAT ID field required?

- A: The VAT ID field is optional by default as not all EU customers are businesses with VAT registration—many are individual consumers. Making it required would prevent non-business customers from completing their purchase. Business customers who need to use reverse charge will voluntarily enter their VAT ID.