Ever lost a sale at checkout? You’re not alone.

48% of customers abandon their cart due to unexpected taxes and fees. With Pro+, you can eliminate that surprise—and win back those lost conversions.

ThriveCart now supports tax-inclusive pricing, so you can display final prices that include local and regional taxes, right from the very first touchpoint in your funnel. This kind of transparency builds trust and boosts global sales, especially in markets like the UK, EU, and Australia where consumers expect upfront pricing.

How to Upgrade to Tax-Inclusive Pricing (in 4 Simple Steps

- Click the banner in your ThriveCart dashboard to upgrade to Pro+

- Go to your Integrations tab in Settings and enable Stripe Connect+ as your payment processor

- Click the button to connect Stripe Connect+ to each product to enable Pro+ features

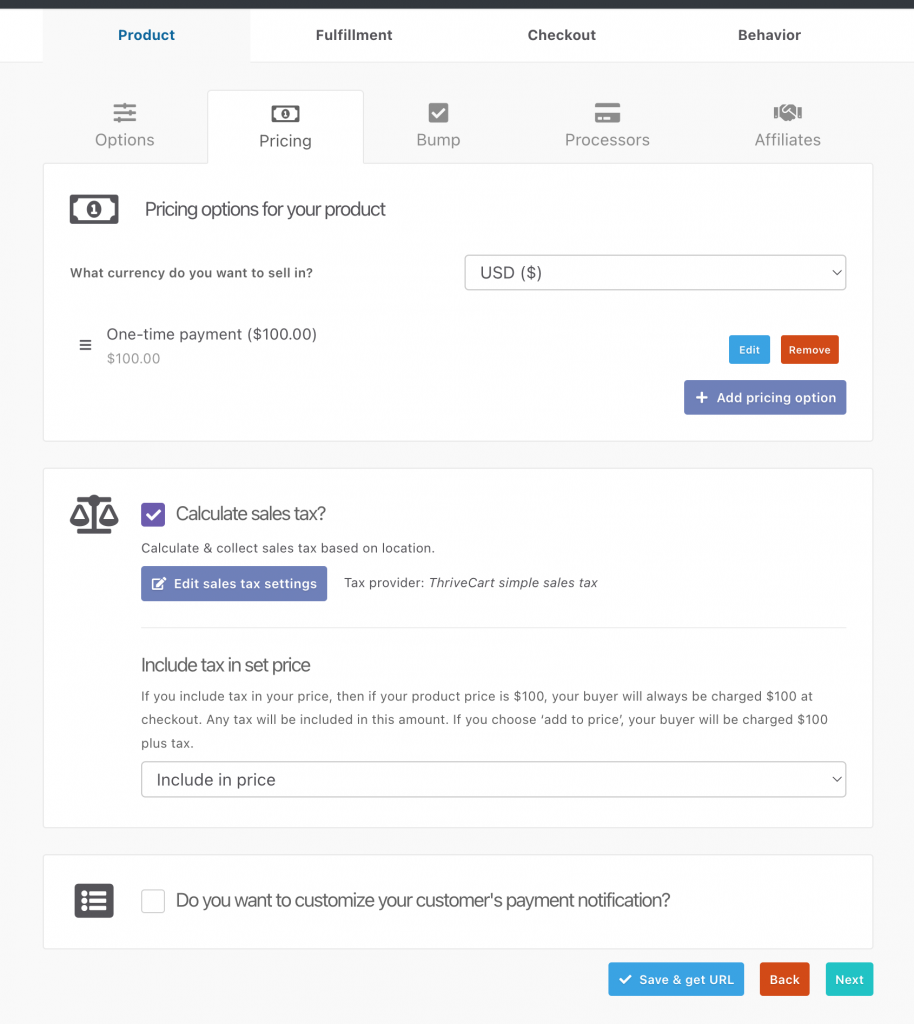

- Under each product’s Pricing settings, choose whether taxes should be included or excluded from the listed price

Tax-Inclusive Pricing also works with PayPal as long as Stripe Connect+ is enabled on the product.

Why it Matters

Customers want to know exactly what they’re paying—no surprises, no friction.

Pro+ users report an average 22% boost in sales by displaying tax-inclusive prices.

This applies across your checkout, order bumps, upsells, and downsells. Whether you’re using ThriveCart’s Simple Sales Tax System or our Quaderno integration, tax-inclusive pricing makes your checkout experience more user-friendly—and more likely to convert.

What does tax-inclusive pricing mean?

Currently, sales tax is typically applied at checkout, which can result in customers seeing a higher total than expected. Tax-inclusive pricing flips the script—taxes are included in the price displayed on your sales pages, product listings, and checkout.

This improves consistency across your funnel and aligns with global buyer expectations. While commission calculations may shift slightly depending on where a customer is based, you still get clear reporting and control.

Example:

If your product costs $100 and your UK customer pays 20% VAT, they’ll still see a total of $100 at checkout. The tax is absorbed into the displayed price, making the process more transparent and trust-building.

What about affiliate commissions?

Affiliate commissions are calculated based on the net amount received from the customer after any included taxes.

For example, if you’re offering a 50% commission and a UK customer pays $100 (with 20% VAT included), the affiliate would earn $41.67. If a customer from Germany pays the same $100 (with 19% VAT included), the affiliate would earn $42.02.

So while tax-inclusive pricing creates a smoother experience for the buyer, commissions remain transparent and proportionate to your actual revenue.

Enabling Tax-Inclusive Pricing

To enable Tax-Inclusive Pricing on your product, you will need to have Stripe Connect+ enabled as a payment processor on your product as a minimum.

Then, you’ll need to save your product settings, and you can then go back to the Pricing tab of your product settings and choose ‘add to price’ or ‘include in price’ for your tax calculation. You’ll want to set this to ‘include in price’ and then save your product.

Need help?

If you need support enabling Tax-Inclusive pricing or upgrading your plan, submit a support ticket here. We’re happy to help!