Give your customers more flexibility at checkout and boost your sales with Buy Now, Pay Later (BNPL) for eCommerce through Stripe Connect+. With ThriveCart payment methods, you can now enable Buy Now Pay Later options like Klarna and Affirm, allowing shoppers to spread their payments over time with convenient installment payment options. Empower your customers to buy with confidence and increase conversions with BNPL, all while keeping your checkout experience smooth and seamless.

BNPL payment methods such as AfterPay, Klarna, and Affirm allow your customers to purchase one-time payment products using interest-free installments, while you as the vendor receive all the revenue upfront – no more following up and fighting to recover missing payments.

This gives your business access to funds immediately, and your customer pays the finance company they have an account with. Giving your customers more options to pay, helps increase your conversions by removing any barriers to purchase.

Enabling Buy Now Pay Later on your checkout

The BNPL options can be individually enabled or disabled in your Stripe account directly under your Settings > Payment Methods area. If you don’t see these options available on your checkout page, be sure to check this area in your Stripe account.

You may see a ThriveCart configuration within the Payment Methods area, but make sure all configurations are set to enable/disable your desired payment methods.

These payment methods are set on an overall Stripe account level and cannot currently be set on a product-by-product basis.

Showing BNPL breakdowns in your pricing options

In addition to showing the payment options for customers to choose from, you can also enable a breakdown of pricing in pricing options (if you have multiple pricing options).

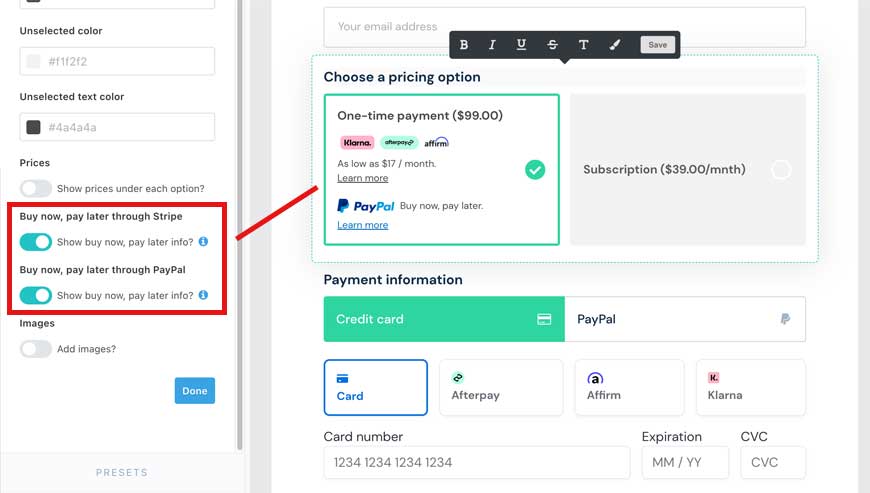

Within the checkout editor, clicking on the pricing options element, the options in the left-hand menu allow you to enable BNPL to show within the pricing option itself.

Please note that this only shows the available BNPL breakdowns returned from Stripe in checkout and you’ll still need to enable the BNPL options within your Stripe account. The examples you see in the editor are simply a preview, but may show differently on checkout based on what is available to the customer.

BNPL Requirements

To be eligible to offer BNPL options on your checkout pages, your Stripe account has to be registered in compatible countries, you have to be selling in compatible currencies (normally the currency of your Stripe account), and your customer has to be in a supported country (normally the same as yours, due to specific BNPL methods not supporting cross-border payments.

Note that BNPL options (with the exception of Klarna) are not available on subscriptions, including one-time payments with a free trial – essentially whenever there is a future payment.

Stripe has a great article on BNPL support here.

But in short, here’s a summary of details:

Supported Countries

Afterpay/Clearpay (Stripe guide here) – Australia, Canada, France, Italy, New Zealand, Spain, UK, US.

Affirm (Stripe guide here) – Canada, US.

Klarna (Stripe guide here) – Australia, Austria, Belgium, Canada, Czechia, Denmark, Finland, France, Germany, Greece, Ireland, Italy, New Zealand, Norway, Poland, Portugal, Spain, Sweden, Switzerland, The Netherlands, UK, US.

Transaction Limits

Afterpay/Clearpay – $1 minimum; $1k – $4k maximum or local equivalent (varies by geo).

Affirm – $50 minimum; $30,000 maximum.

Klarna – $10 minimum or local equivalent. $5,000+ for financing possible; maximum varies by customer.

BNPL Frequently Asked Questions (FAQs)

1. Does BNPL affect upsells?

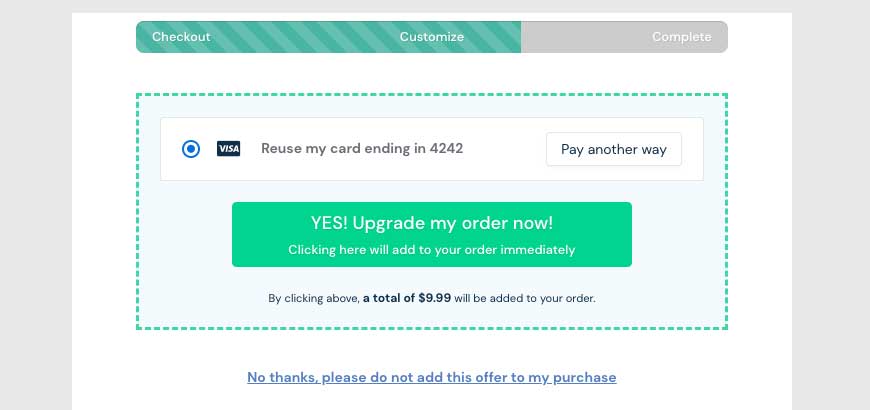

No, they do not! You can set up funnels in ThriveCart where a BNPL option is offered on your front-end (or within the funnel). If the customer is presented an offer that is not supported by a BNPL method, such as a subscription, the customer can look to use a new payment method (such as a card payment, or Apple/Google Pay on compatible devices).

Customers can now continue to use the same payment method throughout the funnel, or change payment methods for different products within the funnel.

2. Can I turn off BNPL on specific products?

No, BNPL and additional payment methods are enabled on an overall Stripe account level.

You can, however, have multiple Stripe Connect+ sub-accounts connected (in Settings > Integrations > Stripe Connect+) where you can set different payment methods in those separate accounts. You would simply need to connect the desired Stripe account in your product settings for what you’re looking to offer.

3. When do I receive payment from customers using BNPL?

Instead of having to wait for each rebill in a payment plan, you get paid upfront by the BNPL provider, and the customer makes recurring payments to them instead.

This means you don’t have to worry about chasing up customers who may fall behind in payments.

Refunds can be processed directly in your dashboard, and the BNPL service manages any stop payments/refunds to the customer for any payments already made.

4. What are the transaction fees for using a BNPL service?

This may vary region to region and from Stripe account to Stripe account. For the most accurate information on transaction fees for these services, we recommend you check within your Stripe account directly, or speak to Stripe Support for more details.

5. My Stripe account is in a supported country, but the BNPL methods aren’t showing on my checkout

Factors like your Stripe account’s registered country, the currency you’re selling in, and the location of your customer (and payment type) will impact whether or not a BNPL option will show on your checkout.

We’d recommend first checking if the payment method is enabled in your Stripe account (Settings > Payment methods) and then checking things like the currency of your product matches your local Stripe account currency and the customer is in the same country. You can confirm with Stripe support directly with specific scenarios as to if a BNPL option should be available.

You’ll also want to make sure that any configurations that you’re seeing within your Stripe account are all set to show the same payment methods.